ROCKVILLE, MD. — Packaged Facts recently released the fourth edition of its “US Pet Product Retail and Internet Shopping Trends” report, detailing a growth in e-commerce sales and steady decrease for in-store purchasing.

According to the report, 2022 e-commerce pet product sales are projected at $30.7 billion, up 16% from 2017 and accounting for 36% of total industry sales. Though in-store pet product sales remain top dog, e-commerce share is expected to reach 45% of total pet product sales by 2026.

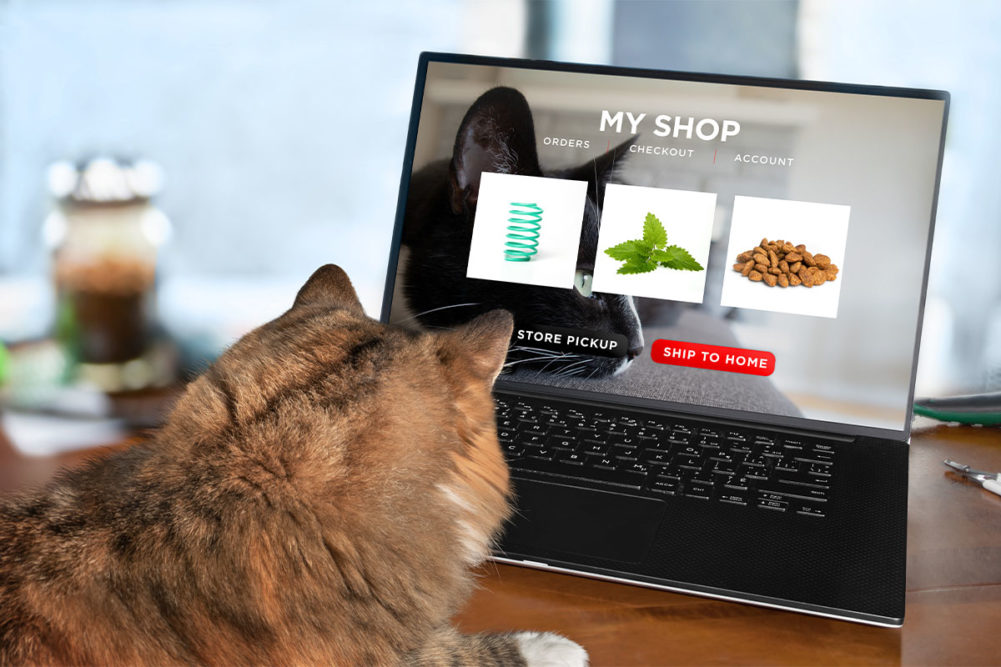

Pet product shoppers are keeping up with larger consumer shopping trends, utilizing a mixture of in-store, online, mass-market and specialty channels to buy pet products and furthering the omnichannel trend. According to Packaged Facts, 51% of Walmart’s pet product shoppers also buy pet products at supermarkets, 33% also buy online, and 27% also shop via pet specialty retailers.

Though pet parents are using a variety of channels to purchase pet food and supplies for their furry companions, Packaged Facts claims that retailers outside of the pet specialty arena may have the edge in upcoming sales growth based on the significant number of retailers not included in the specialty market.

Fueled by the COVID-19 pandemic, direct-to-consumer delivery has remained popular with consumers and pet parents. This convenient offering could now allow supermarket chains to ramp up their pet product sales that were lost to Amazon, Chewy, PetSmart and Walmart, according to the report.

Regarding product trends, Packaged Facts also revealed that 24% of dog and cat owners are using private-label products. Of the 18% of dog owners that purchase dog treats, half (9%) only use private labels. Private-label purchasing is also popular for wet and dry dog food.