After the second full year of an international health pandemic, food safety and sanitation are top of mind for processors throughout the meat and poultry industry. As processors plan ahead for 2022, allocating dollars for capital improvement and expansion, it’s no surprise to see that 58% of processors in MEAT+POULTRY’s 2021-2022 Industry Outlook Study plan to focus their 2022 capital investments on improving food safety and sanitation.

“For meat processors, the main driver of the capital investment plans that they have is to improve food safety,” said Marjorie Hellmer, president of Cypress Research. “It’s always an important driving issue in food processing and in meat processing plants too, but I believe that it has achieved a higher priority this time, ranked against other goals, due to the context of this global health crisis.”

The goal of the 2021-2022 Industry Outlook Study was to track business outlook and capital spending trends among meat and poultry processors. This year’s study was commissioned by MEAT+POULTRY in collaboration with the North American Meat Institute (NAMI) and conducted in September and October 2021 by Kansas City, Mo.-based Cypress Research. The collaboration allowed for a representative sample of industry professionals, from the MEAT+POULTRY readership and NAMI membership, for use in the research.

Data from study by Cypress Research that was commissioned by the North American Meat Institute and MEAT+POULTRY

Data from study by Cypress Research that was commissioned by the North American Meat Institute and MEAT+POULTRY

Study participants

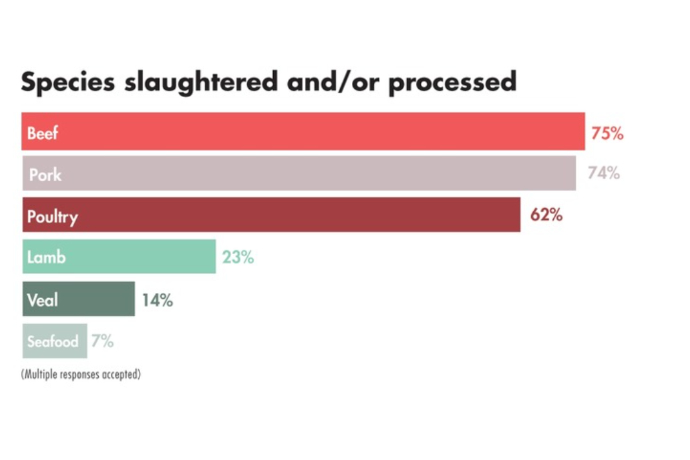

The September and October online survey included 460 respondents from the meat and poultry industry – 88% were in the processing or further processing segment of the industry and 46% of respondents were from businesses involved in slaughter/fabrication. Because respondents could indicate more than one species their company slaughters and/or processes, 75% of respondents are in involved with beef; 74% from the pork side; 62% work with poultry; 23% are involved with lamb; 14% process veal and 7% process seafood.

The professionals responding to the study were from companies of all sizes. Twenty-nine percent represented companies with sales of $500 million or more; 20% represented $100 million to $499 million companies; 14% represented $50 million to $99 million companies; and 37% of respondents were from smaller companies with annual gross sales revenues of less than $50 million.

The professionals responding to the survey mostly represented corporate management, plant operations and production and sales and marketing positions within their prospective companies.

“These are professionals in key decision-making roles for their companies – from C-suite to operations to food safety,” Hellmer said. “The focus of the study is on the state of the industry and their businesses, so we needed people in key roles within their company that could answer these types of questions about operations and capital investing. We also wanted to ask, ‘What is your outlook, not just for your company, but for the industry as a whole, both in the US and globally?’ So, we needed to survey people in those positions in close proximity to these particular issues.”

Economic outlook

Survey questions took both a macro and micro look at the industry and what participants considered the outlook to be. When asked if the US economy is growing, most participants (56%) said yes. However, only 43% were optimistic about the US economy over the next 12 months.

When comparing industry outlook from 2020 to 2021, 52% of meat and poultry processors report a better current year company outlook (32% report the same; 16% report a worse outlook for their company). When taking a broader look at the US meat and poultry industry as a whole, only 38% report a better outlook from 2020 to 2021, and 38% and 23% report the same or worse outlook for the US industry, respectively.

Meat and poultry processors are more positive about their current year company outlook than toward the US meat and poultry industry. Eighty-five percent are somewhat positive or very positive about their own company’s outlook, while only 68% are somewhat positive or very positive about the US industry’s outlook.

“There’s a significant portion of the industry here that’s telling us that they have some concerns about the health of the US and global industries as we wrap up 2021,” Hellmer said. “But overall, it’s quite positive.”

Moving into projections about 2022, again respondents have a more positive outlook when examining the future outlook of their own companies compared to the US or global meat and poultry industries. Eighty-five percent are positive about the 2022 outlook of their companies compared to 72% for the US meat and poultry industry and 69% for the global industry.

“These study trends suggest concern for the health of the US and global meat industries,” Hellmer said. “I think that’s a reflection of so many unknowns related to the pandemic. There are supply chain issues, there are higher material costs, energy costs, challenges with transportation. And we have the appearance of omicron and here in the United States, the delta variant is continuing to surge. So, as we look ahead to next year, I think there are so many unknowns that are wrapped up with the pandemic and the potential effect that it could have.”

Making Sales

Eighty-three percent of the survey participants sell meat products in the retail channel, while 76% sell to foodservice and 72% to distributors. Across the board, sales have increased in each sales channel when comparing 2020 to 2021 and when comparing anticipated sales for 2022 with projected year-end 2021 sales.

The foodservice channel when compared to retail and distributor channels showed the most recovery between 2020 and 2021 with 62% of companies expecting an increase, 21% staying the same and 17% anticipating a decrease. When comparing 2021 to projected 2022 sales, 66% of companies expect the foodservice channel to increase, while 27% say stay the same and only 7% anticipate a decrease in foodservice sales in 2022.

“The 2021/2020 foodservice channel trend is showing us the biggest channel recovery of the three channels because that channel was hardest hit in 2020, and therefore, bounced back more in 2021 than the other two channels,” Hellmer explained. “And challenges continue to plague the foodservice channel because of the persistence of COVID variants and companies’ varying abilities to regain their footing in this uncertain climate. Processors are telling us that they expect continued recovery next year in the foodservice channel but not without ongoing challenges – this holds true across all sales channels.”

Labor concerns

Heading into 2022, 58% of meat and poultry processors put 2022 capital investments toward improving food safety/sanitation. Fifty-four percent want to increase capacity for existing products and improve product quality, consistency and accuracy.

Labor issues also were among the top goals for 2022 capital budget allocations with 52% wanting to make accommodations for lack of skilled labor, possibly suggesting an increase in automation equipment, and 43% wanting to spend money to help reduce labor costs.

Hiring and retaining employees is a challenge across the United States in most industries, meat and poultry processing included. Sixty-nine percent of participants in the survey said their companies planned to add employees throughout 2021, and 29% are holding their workforce steady.

“Hiring does seem to be at healthy levels again during this current, very stressful economic period, so that’s a great sign of health within the industry,” Hellmer said. “Of course, the more immediate challenge for companies is finding the talent to bring into a company. Everyone’s struggling to find employees.”

When taking a closer look at business concerns heading into 2022, lack of skilled workforce topped the list (81% of respondents reported this as their top concern). Labor costs followed at 78% and energy and raw material costs and transportation and shipping costs at 60% and 51%, respectively.

“This is a perennial challenge within food manufacturing. We know that workforce related issues have blown up within the broader US economy. And what this means is that downward pressure – the difficulties in finding talent, skilled and unskilled, have only been exacerbated by the pandemic. So, it’s not surprising that these are the two leading concerns for the processors in this study,” Hellmer said. “The other leading concerns are related to the cost of energy and raw materials and they are having concerns about transportation and shipping costs. We all know the shortage of drivers, we all know the bottleneck in getting products into our country, with the shipping lanes being clogged and the ports being backed up. So, these are the other two leading concerns, not surprisingly.

“And more than 40% of processors continue to be concerned about COVID infection surges, which we are going to see increasing challenges with,” Hellmer concluded.

To access the entire Industry Outlook Study, contact Publisher Dave Crost at [email protected].