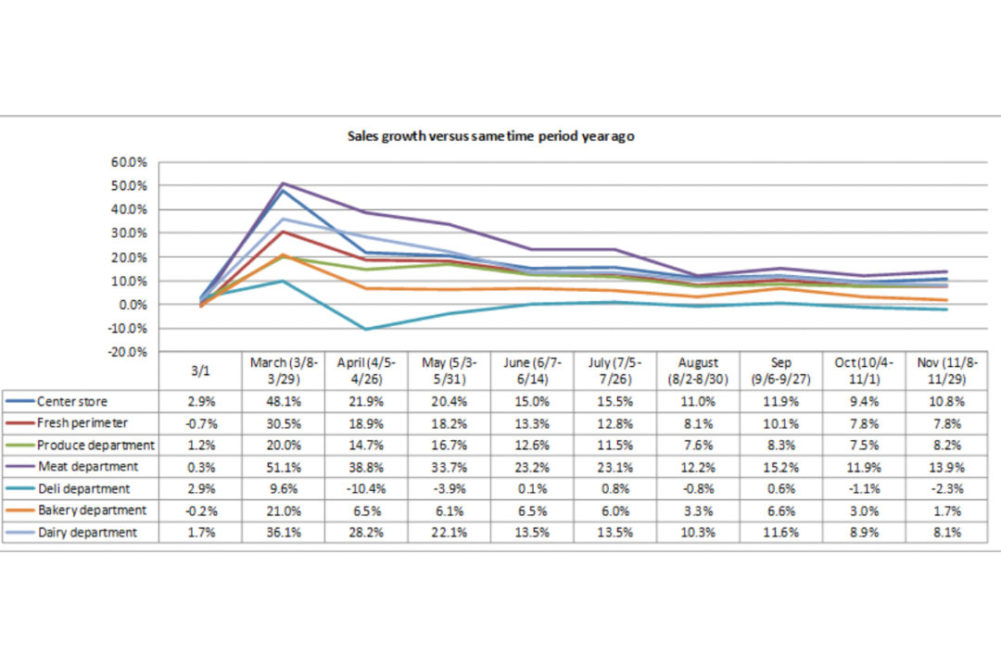

SAN ANTONIO – Even though Thanksgiving celebrations looked different this year, consumers still did enough fresh perimeter shopping in the month of November to outdo 2019 sales by 7.8%, according to the latest report from 210 Analytics and IRI.

“Shoppers told us they would do their Thanksgiving shopping earlier and they did,” said Jeremy Johnson, vice president of education for IDDBA. “Understanding the Thanksgiving results requires looking at a longer time frame and taking e-commerce into account. The end-of-year holiday sales will be no different. Now it will be all about applying the lessons from the pandemic-affected holidays thus far in the next few weeks and months. Easter falls relatively early in 2021 and will likely see continued pandemic effects.”

Of the fresh departments, meat continued to see the highest year-over-year growth with dollar sales up 13.9%. Dollar wise, lamb (up 34%) was the top performing meat. Beef was up 19%, chicken was up 12%, turkey was up 7% and pork was up 12%.

Produce also continued to see success with the overall category sales coming in 8.2% higher in November 2020 compared to 2019. Vegetables (up 11.2%) performed better than fruits (up 5.4%). The most elevated sellers in the category included melons (up 21.4%), cucumbers (up 21%) and salad kits and lettuce (up 19.7%).

“Retail produce sales delivered a strong performance in November,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “The very different Thanksgiving celebrations benefitted retail, but ultimately balance between retail and foodservice is what benefits our industry as a whole. The end-of-year celebrations are likely to look equally different and looking back at the lessons from Thanksgiving may help streamline operations for the weeks to come. It is likely we will see highly elevated online orders, earlier shopping and different choices to accommodate for the smaller gatherings.”

The dairy department was elevated 8.1% in the month of November. Whipped toppings saw the highest gain in the category at 14.6%, followed by natural cheese at 13.4% and cream/creamers at 10.6%.

As in previous months, the deli department saw mixed results, with an overall loss of 2.3% year-over-year. Deli cheese and deli meat saw gains of 10.7% and 8.2%, respectively, while deli prepared and deli entertaining saw losses of 10.6% and 2%, respectively.

“After cooking all year, it seemed that at least some folks were ready to hand off the preparation to others,” said Eric Richard, industry relations coordinator with IDDBA. “Holiday meal solutions were up 20.6% and promise to be big again in December. Additionally, side dishes are doing well in the frozen food aisles and in deli, underscoring that many shoppers combine items they cook from scratch with heat-and-eat and ready-to-eat items.”

According to the latest weekly shopper survey wave by IRI, conducted mid-November, the holidays will involve much less travel and smaller gatherings:

- Only one in four shoppers plan to celebrate with others outside their household, about half the rate of 2019.

- One in three expect to spend less on groceries for the December holidays this year, primarily due to hosting fewer/no guests this year or cutting back to save money.

- For New Year’s, 30% plan to celebrate at home without guests, while only 5% of primary grocery shoppers plan to go to a party/gathering, 4% host others, and 3% go to a bar/restaurant. 10% celebrated last year but won’t do anything either at home or away from home to ring in the New Year (51% typically don’t celebrate).

“These predictions point to many potential changes for the deli, dairy and bakery departments,” said Anne-Marie Roerink, president of 210 Analytics. “Much like the pandemic-affected holidays to date, the industry may consider messaging and promotions that help shoppers find new ways to make the holidays special at home or on a tighter budget, and retailers should plan for an earlier spike in holiday item purchasing than last year.”